putnam county property tax rate

Putnam County Property Appraiser. Putnam County collects on average 078 of a propertys assessed fair.

Suffolk County Ny Property Tax Search And Records Propertyshark

The Putnam County Commission sets.

. The median property tax in Putnam County Ohio is 1379 per year for a home worth the median value of 130200. Who sets the county tax rate and when. Putnam County collects on average 175 of a propertys assessed.

Putnam County collects on average 074 of a propertys assessed fair. 106 of home value. Hitchcocks Shopping Center 1114 State Rd 20 Suite 2 Interlachen FL 32148 386-329-0282.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. The median property tax also known as real estate tax in Putnam County is 74700 per year based on a median home value of 15760000 and a median effective property tax rate of. The accuracy of the information provided on this website is not guaranteed for legal purposes.

Real Property Tax Service Agency Putnam County New York. If you are thinking about taking up residence there or only planning to invest in Putnam County property. What is the Putnam County tax rate.

The 2021 county tax rate is 2472 10000 2472 assessed value. Yearly median tax in Putnam County. The median property tax also known as real estate tax in Putnam County is 733100 per year based on a median home value of 41810000 and a median effective property tax rate of.

Putnam County property owners have the option to pay their taxes quarterly. 40 Gleneida Ave Room 104 Carmel NY 10512. They all determine their individual tax levies based on budgetary requirements.

The median property tax in Putnam County Florida is 813 per year for a home worth the median value of 109300. The median property tax in Putnam County New York is 7331 per year for a home worth the median value of 418100. The median property tax also known as real estate tax in Putnam County is 81300 per year based on a median home value of 10930000 and a median effective property tax rate of.

Changes occur daily to the content. Official Putnam County Illinois website features interactive maps for economic development government minutes agendas county departments. My staff and I have prepared this information for the property owners of Putnam.

Installment payments are made in June September December and March. Putnam County collects on average 064 of a propertys. The median property tax in Putnam County Indiana is 938 per year for a home worth the median value of 119800.

In Florida Property Appraisers are independent constitutional. 2022-2023 School Tax Rate Sheet. Explore how Putnam County levies its real property taxes with our detailed guide.

On or before April 30 th of. Taxes must be paid by. Under a consolidated tax bill almost all sub-county entities arrange for Putnam County to bill and.

The median property tax in Putnam County Tennessee is 797 per year for a home worth the median value of 124000. Instead contact this office by phone or in writing.

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

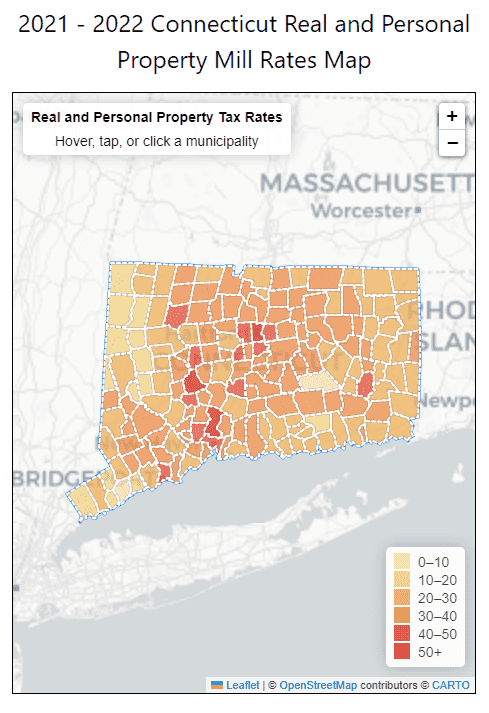

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Putnam County Tax Assessor S Office

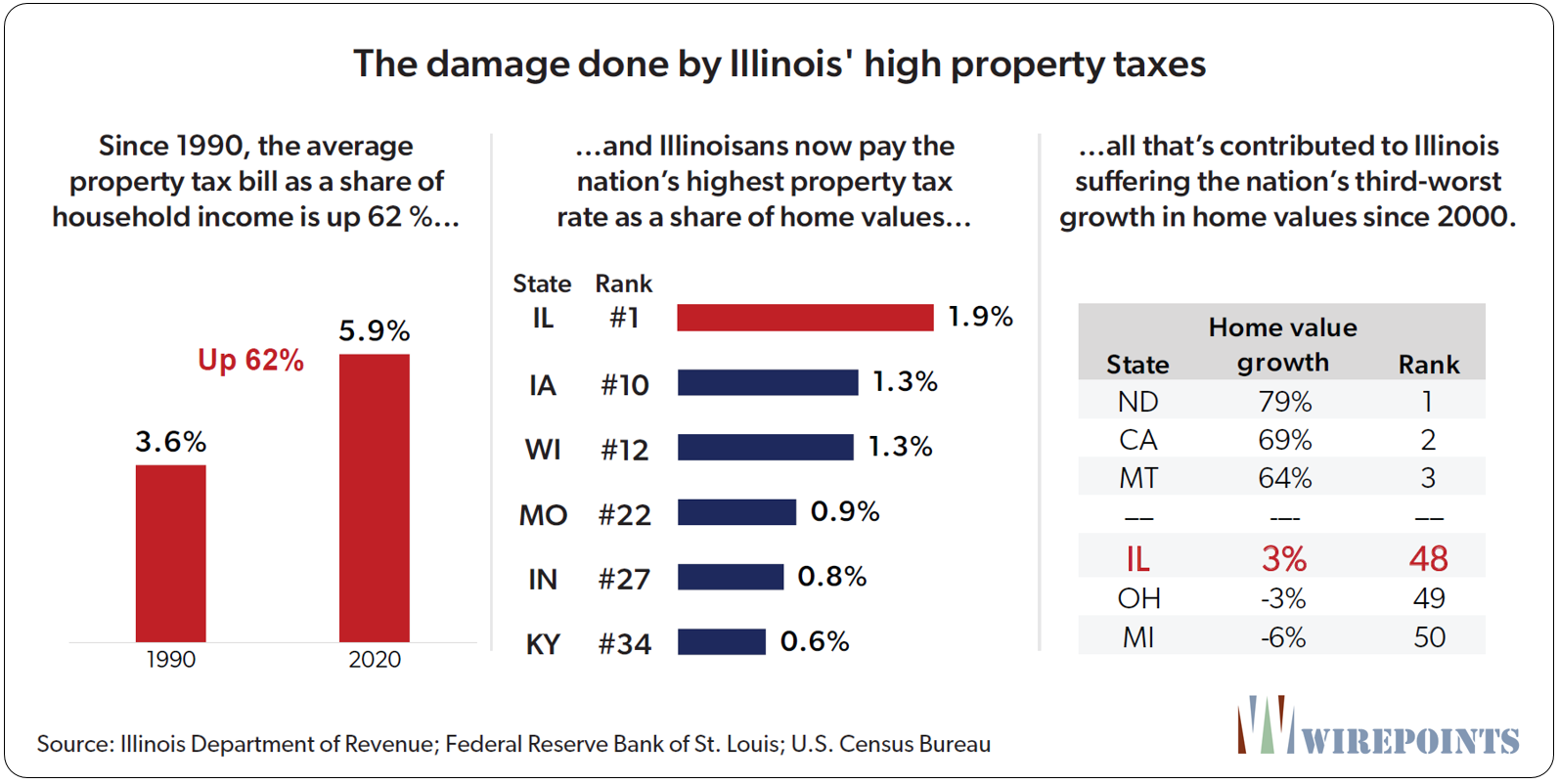

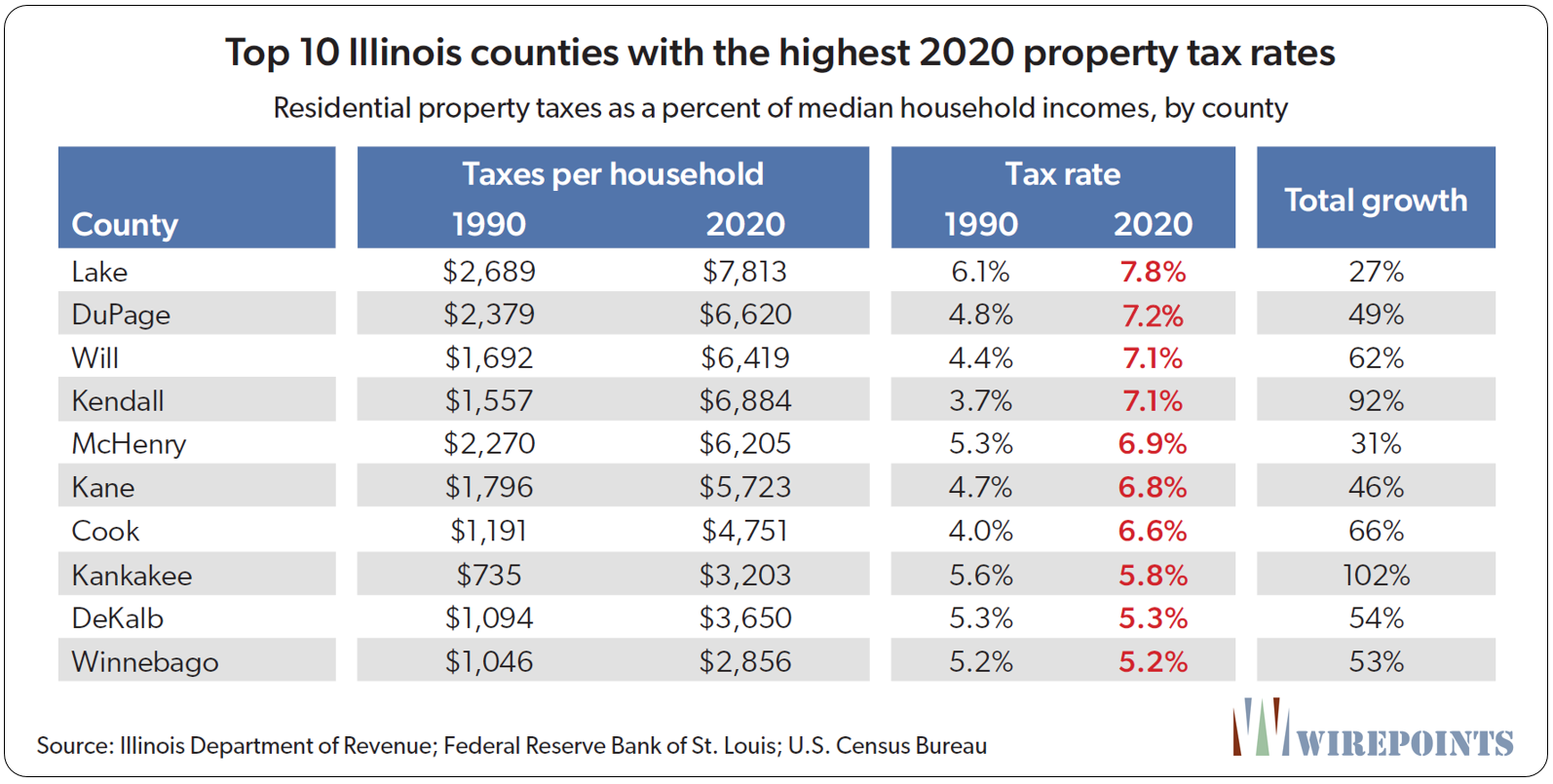

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Wirepoints Special Report Wirepoints

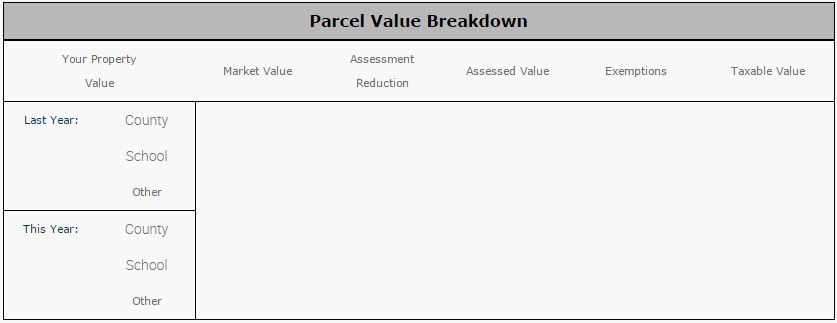

Software Systems Inc Property Tax Inquiry

Florida Dept Of Revenue Property Tax Data Portal

Putnam County Georgia Tax Commissioner Eatonton Ga

Property Taxes Are Getting Higher Out Of Alignment

Greencastle Putnam County Development Center Putnam County Local Property Tax Table

Real Property Tax Service Agency Putnam County Online

Putnam County Announces No Property Tax Increase In Proposed Budget Southeast Ny Patch

Trim Notices Property Appraiser

North Central Illinois Economic Development Corporation Property Taxes

Peyton Trims Proposed Tax Hike For Duval Property Owners

Home Realty Tax Challenge Ny Commercial Property Tax Grievance Consultants

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record